Improve Your Article Writing With Five interesting Keyboard Shortcuts

Many writers have complained about the inability to use the available computer facilities to enhance their article writing services deliveries. If you too face a similar problem, then read further to learn some interesting shortcut techniques to improve your writing speed. Five Basic Shortcut Keys That Can Help You Do Wonders In Your Writing Text […]

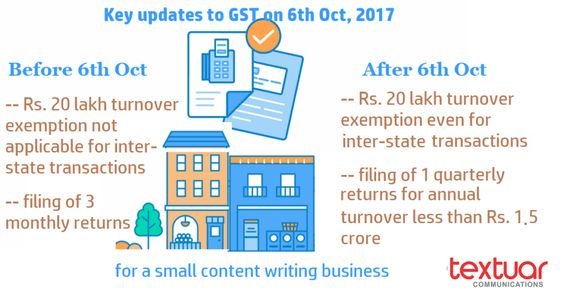

New GST Changes for Small Content Writing Businesses

July 2017 heralded the launch of GST in India, where every goods producer or services supplier needed to be included in the GST regime. For content writing services companies too, they needed to register for GST, pay GST monthly, and file 3 monthly returns. If they provided inter-state transactions then they had to pay GST […]

Watch Out… For these Top 4 Content Marketing Trends in 2015

When content writing services, publication and content distribution are planned strategically, it helps marketers draw in readers and engage them to close sales better. The insights, approaches and methods adopted by the content marketing sector will help you decide whether your 2015 content endeavors are well thought out and apt for today’s times. So, […]