“I don’t have a GST number. What do I do? Can I continue working for you?” This is a common lament amongst freelance content writers in India with the advent of GST. With large scale confusion spread across the nation, it is a common doubt for content writers in India. Even clients of content writing service providers are confused. Should they award work to an unregistered freelance writer? Should they compulsorily need to request GSTIN from freelance writers before providing them projects to work on? What happens to on-going writing projects in the interim?

In order to eliminate all doubts around content writers and GST, here is a quick post.

What is GST?

GST is an umbrella tax that is to be collected and paid to government on selling of goods and services. For content writing services in India, the GST rate is fixed at 18% of the taxable value of service. Currently there are three types of GSTs applicable and the 18% GST needs to be treated as below –

1 – cGST and sGST = to be levied if seller and client are from same state (basically the tax is split between state and central govt.)

Rate = 9% cGST and 9% sGST

2 – iGST = to be levied if seller and client are from different states

Rate = 18% iGST

3 – Exemptions for content writers in India

- If you have all clients in your own state and your earnings are less than Rs. 20 lakh then you are exempt from paying GST on content writing services in India

- If you have all clients in your own state and your earnings are more than Rs. 20 lakh then you need to pay GST on content writing services in India

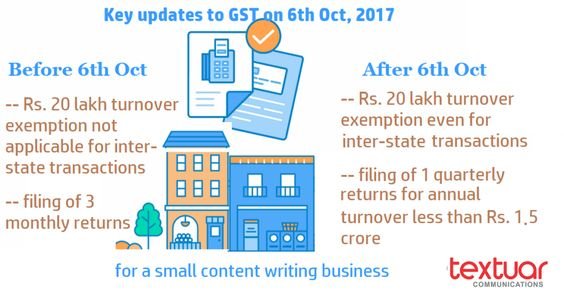

- If you have even a single client in any other state outside your home state, then you need to pay GST irrespective of your earnings

What changes for content writers in India?

- For registered content writers

1 – Information sought from buyer/client – PAN, GSTIN, Company name and full address for tax invoice

2 – Service Tax is abolished and GST needs to be charged from client

- For unregistered content writers

1 – Information sought from buyer/client – Company name and full address for tax invoice

2 – Service Tax is abolished and GST too is not to be charged

If you are a full time content developer we suggest you go for a GST number and comply by its provisions. You may not see any difference now, but it will be of significant impact when your business grows

Some clients may flat out refuse to work with you if you do not get a GST number, thus leading to loss of business

Documents for GST Registration

- Authorized signatory photograph

- Photo of proprietor (in case of sole proprietorship),

- Photo of designated partner (in LLP), or

- Photo of full time director (for pvt. ltd. company)

- Registration proof

- Partnership deed (for LLP),

- Registration Certificate (for companies and LLP)

- No registration proof needed from individual proprietors

- Proof of place of business

- Owned property proof (light bill, property tax bill, registry receipt)

- Rented property proof (lease agreement, light bill in name of landlord)

- If neither then submit light bill and NOC from property owner

- Bank statement

- Cancelled cheque copy

- Authorization form

GST Compliances

- Raise proper tax invoice for every single payment received

- Upload invoice issued to govt.

- File 3 returns every month

- GSTR-1 for all services supplied outwards to clients – by 10th of every month

- GSTR-2 for all services received inwards from vendors (in case you outsource work to other freelancers) – by 15th of every month

- GSTR-3 for recording all entries of GSTR-1 and GSTR-2. This is auto-prepared by the system – by 20th of every month

- Maintain sales and purchases ledger

Do feel free to ask in case of queries.

Happy Writing!