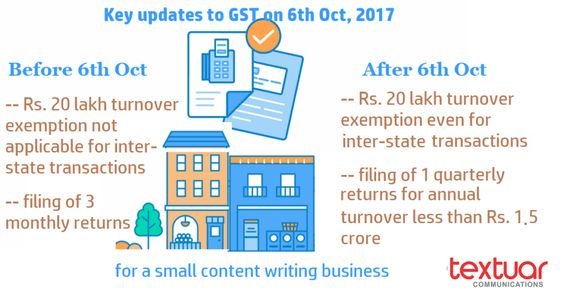

July 2017 heralded the launch of GST in India, where every goods producer or services supplier needed to be included in the GST regime. For content writing services companies too, they needed to register for GST, pay GST monthly, and file 3 monthly returns. If they provided inter-state transactions then they had to pay GST and the small business exemption (for those below Rs. 20 lakh annual turnover) didn’t apply to them.

What has changed from 6th October 2017?

In a landmark press conference of the GST Council, the finance minister, Arun Jaitley announced a slew of GST relaxation for different industry verticals. Right from small items producers to unbranded Ayurvedic items, there was a drop in GST rates for as many as 27 products and a few services.

Even in the field of content writing businesses who fall under the small to medium enterprises, there has been substantial development:

1 – Change to GST treatment

GST Legislation before 6th Oct 2017

For content writing services companies with an annual turnover of less than Rs. 20 lakh, they were earlier exempted from GST only if they were within the state. For inter-state transactions, it didn’t matter even if they were below Rs. 20 lakh, they still had to pay GST.

New GST legislation after 6th Oct 2017

For content writing service companies dealing in inter-state services or intra-state services, they are now exempt from GST if their total turnover is below Rs. 20 lakh.

2 – Frequency of filing returns

GST Legislation before 6th Oct 2017

Content writing services providers needed to file 3 monthly returns along with one annual return filing (total of 37 returns in a year).

New GST Legislation before 6th Oct 2017

Content writing services companies with a total annual turnover of less than Rs. 1.5 crore will need to file returns quarterly. This will in turn dramatically bring down the amount of compliance needed.

Check Government notification for both these updates (Find the word “Relief for Small and Medium Enterprises” within the PDF file), and for all the new updates to GST regime.